From May through July 2020, MPI had a pair of surveys out in the field to learn more about the impacts—expected and realized—of the coronavirus pandemic on aspects of the meeting and event industry. Theses surveys, the MPI Impact Sentiment Study and Recovery Index, were sponsored by The Venetian Resort Las Vegas and the IMEX Group.

The MPI Impact Sentiment Study (June 9-July 8)

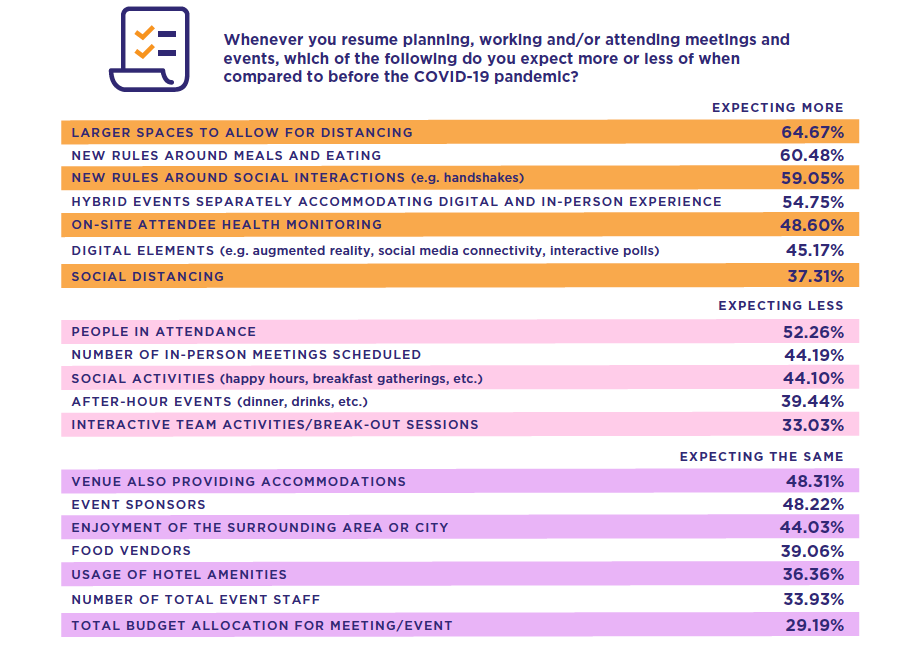

It’s clear that when meetings and events start up again, they won’t look like those from pre-pandemic times.

Expect more:

· Rules around social interactions and dining

· Onsite health monitoring

· Space to allow for distancing

· Hybrid events

Expect fewer:

· Attendees

· Number of meetings/events

· After-hour/social gatherings

· Interactive team activities

While responses from planners and suppliers are generally in sync when it comes to what’s anticipated in meetings/events after the pandemic, there are some notable variances between U.S.-based and non-U.S.-based respondents.

International respondents shared a slightly more positive outlook in a few categories.

· 14% of U.S.-based respondents expect an increase in the number of in-person meetings, compared to 28% of non-U.S.-based respondents

· 33% of U.S.-based respondents expect an increase in the total budget allocated for meetings/events, compared to 43% of non-U.S.-based respondents

Specific to travel, all respondents expect to see more driving to events with less air travel as well as fewer available flights.

“No matter the location, I will not fly to attend,” said one anonymous U.S. respondent, reflecting a concern shared by many in the survey’s comments. “I will only attend if I can drive.”

The most notable differences between travel-related data from U.S.-based and non-U.S.-based respondents include:

· 84% of U.S.-based respondents expect more driving to meetings/events, compared to 69% of non-U.S.-based respondents

· 14% of U.S.-based respondents expect an increase in usage of shuttles to/from the airport, compared to 29% of non-U.S.-based respondents

· 11% of U.S.-based respondents expect to utilize more food vendors, compared to 25% of non-U.S.-based respondents

The comments shared by respondents reveal that the vast majority are expecting—and OK with—masks, social distancing and the widespread use of hand sanitizer. Numerous commenters don’t expect a return to pre-pandemic norms until an effective vaccine has been successfully deployed. On a positive note, among the Impact Sentiment Study’s nearly 1,800 respondents, no one expressed the belief that the coronavirus pandemic is overblown or an outright hoax—notions that popped up in numerous MPI surveys earlier this year.

Download a three-page infographic with additional results from the MPI Impact Sentiment Study.

Recovery Index (May 1-July 31)

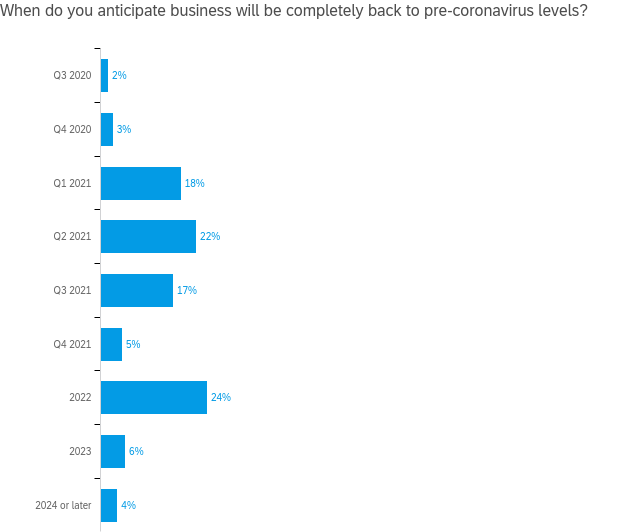

With each passing week, our Recovery Index revealed respondents increasingly eyeing a later date for the return of business.

For instance, as of May 8, 24% of respondents expected to once again hold face-to-face meetings/events in September, while 21.2% expected the same to occur “sometime in 2021.”

When the survey was closed on July 31, the percentage of respondents looking at a September return had dropped to 21.1%; “sometime in 2021” had grown to 27.8%.

As the pandemic failed to retreat as some had hoped or expected, the business year of 2020 increasingly looked like a wash, with respondents looking forward to recovery and relief next year.

Accordingly, when asked about the timing of a return to pre-pandemic business, the most popular option was “2022.”

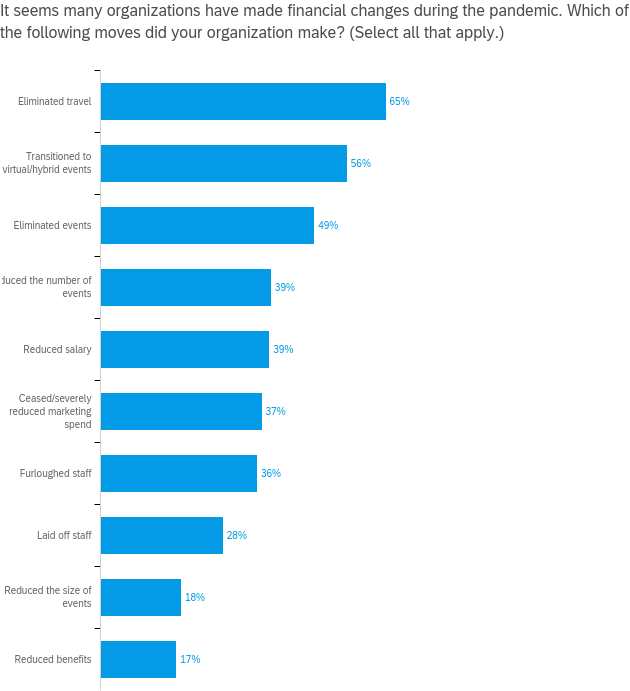

The most common cost-savings actions by industry organizations include Eliminating Travel (65%), Transitioning to Virtual/Hybrid Events (56%) and Eliminating Events (49%).

Meanwhile, 75% of respondents expect to welcome back furloughed staff this year; 58% of respondents expect to fill positions for which staff had been laid off sometime in 2021. Benefits and salaries are also expected to return to pre-pandemic levels sometime in 2021.

Overall, respondents reported their current business to be approximately one-third (37%) of that from a year ago.

.jpeg?sfvrsn=96553155_2)